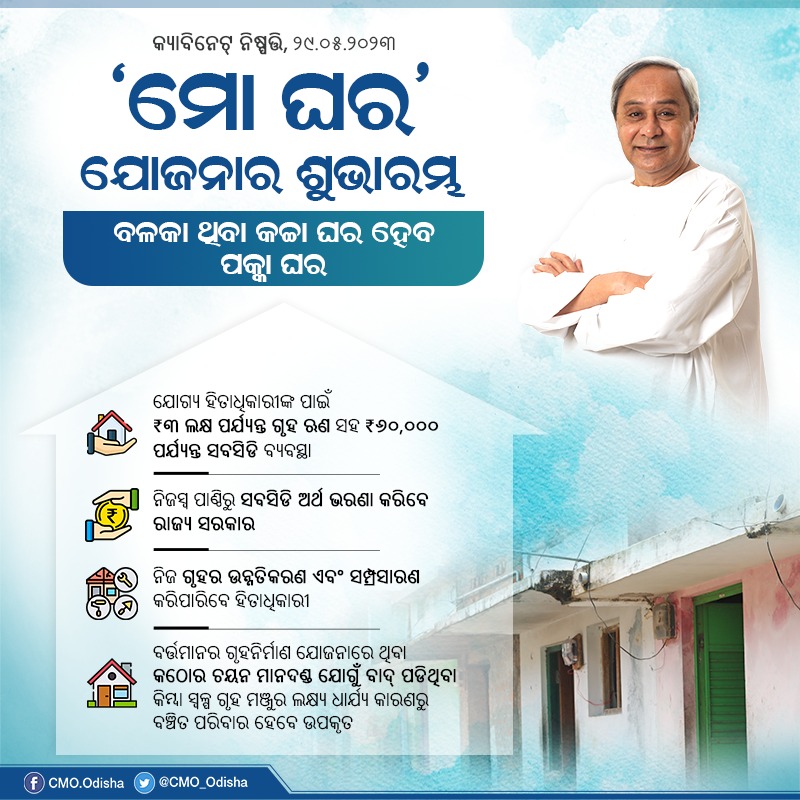

Mo Ghara Scheme:- The Naveen Patnaik Government has introduced the Mo Ghara Yojana on May 29, aiming to provide credit-linked financial support to those facing budget constraints for constructing or repairing their homes. This initiative is a significant relief for economically and socially weaker sections of society. As the BJD government in Odisha completes its fifth term, it has recently accepted 18 crucial initiatives, including the Mo Ghara plan, which addresses the housing needs of the underprivileged. Let’s delve into the details of the Mo Ghara Scheme Odisha, covering its highlights, objectives, features, benefits, eligibility criteria, required documents, and the application procedure.

Mo Ghara Yojana Odisha 2024

Chief Minister Naveen Patnaik presided over the Cabinet meeting where the decision to implement the Mo Ghara Yojana was made. This program aims to assist families excluded from existing housing programs due to strict eligibility requirements or insufficient funding. It also targets those who previously received lower amounts of housing assistance and now seek to upgrade or expand their homes. The credit-linked housing program, fully supported by the State budget, received approval from the State Cabinet. Applications for loans will be accepted from June 15, 2023, onwards.

Cabinet Approval and Initiatives

The new “Mo Ghara” yojana is among the 18 proposals approved by the Odisha Cabinet. This approval follows the recent addition of three new ministers to the Council of Ministers in Odisha, signaling a commitment to addressing the housing needs of the rural population. The State Government is set to allocate funds under the Mo Ghara Yojana in the Panchayati Raj & Drinking Water Department, benefiting lower and lower-middle-class households in rural areas.

Odisha Mo Ghara Scheme Details in Highlights

|

Yojana Name |

Mo Ghara Yojana |

|

Introduced by |

Odisha Government |

|

State |

Odisha |

|

Year |

2023 |

|

Beneficiaries |

Lower Middle-Class People of Odisha |

|

Objective |

Contribute financially to the building of a Pucca House |

|

Loan Amount |

Rs 3 Lakh |

|

Subsidy Amount |

Rs 70,000 |

|

How to Apply |

Online/Offline |

|

Official Website |

https://rhodisha.gov.in |

|

Help Line Number |

0674-6817777 |

Objective of Mo Ghara Yojana Odisha

The State Cabinet’s approval of Mo Ghara aims to offer financial support to rural Odisha households with lower and lower-middle incomes, enabling them to fulfill their housing aspirations. The program will encompass families excluded from existing housing programs due to strict eligibility requirements or insufficient funding.

Features and Benefits of Odisha Mo Ghara Yojana 2024

Some key features and benefits of Mo Ghara Yojana include:

- Pucca housing provided to the rural poor, elevating their standard of living.

- Reduction of vulnerability to disasters for the poor in rural areas.

- Enhancement of the rural poor’s sense of dignity.

- Contribution to the rural communities’ economic growth.

Housing loans up to Rs. 3 lakh, with a one-year moratorium term, can be obtained by Yojana beneficiaries. Over a ten-year period, loans must be returned. The loan amount slabs are Rs. 1 lakh, Rs. 1.5 lakh, Rs. 2 lakh, and Rs. 3 lakh, as per the Cabinet notification. Eligibility extends to those with monthly incomes below Rs. 25,000 and those who have previously received housing aid totaling Rs. 70,000 or less.

Mo Ghara Yojana Odisha Loan Subsidy Amount

|

Loan Amount |

Subsidy Provided |

|

1 lakh |

30,000 Rupees |

|

1.5 lakh |

45,000 Rupees |

|

2 lakh |

60,000 Rupees |

|

3 lakh |

60,000 Rupees |

Eligibility Criteria for Mo Ghara Yojana Odisha

Applicants must meet the following eligibility criteria:

- Permanent residence in Odisha.

- No ownership of a pucca house in Odisha, residing in a kuccha house.

- Fall under the EWS classification.

- Family income less than Rs. 25,000 per month.

- No previous receipt of government housing aid.

Required Documents to Apply

Essential documents for Mo Ghara Yojana Odisha application:

- Passport size photograph

- Aadhaar Card

- Voter ID Card

- Address Proof

- Identification Proof

- Residence Certificate

- Bonafide Certificate

- BPL Certificate

- EWS Certificate

Application Procedure for Mo Ghara Yojana Odisha 2024

- Visit the official website https://rhodisha.gov.in/moghara/.

- Click on the Registration option.

- Fill the application form with all important documents.

- Upload all necessary documents.

- Login with the provided details.

- Enter additional information in the application form.

- Click the Submit button after the application process is complete.

Conclusion

Mo Ghara Scheme Odisha stands as a commendable initiative by the Naveen Patnaik Government to address the housing needs of the rural poor. By providing financial support and promoting the construction of pucca houses, the program contributes to elevating the living standards of the economically weaker sections. This step towards inclusive development aligns with the government’s commitment to ensuring housing for all.

Mo Ghara Yojana Important Links

|

Official Website |

|

|

Home Page |

|

|

Join our Telegram group |

|

|

Join our Whatsapp group |

Mo Ghara Scheme FAQs

Q:- Who introduced Mo Ghara Scheme in Odisha?

Ans:- Mo Ghara Scheme was introduced by the Naveen Patnaik Government.

Q:- What is the loan amount available under Mo Ghara Scheme?

Ans:- Beneficiaries can avail a housing loan up to Rs. 3 lakh.

Q:- When can applicants start applying for Mo Ghara Scheme?

Ans:- Applications for loans will be accepted starting from June 15, 2023.

Q:- What documents are required for Mo Ghara Scheme application?

Ans:- Essential documents include Aadhaar Card, Voter ID Card, Residence Certificate, and others.

Q:- How does the subsidy amount vary for different loan slabs?

Ans:- The subsidy amount varies, with the highest subsidy of Rs. 60,000 provided for a loan of Rs. 2 lakh and Rs. 3 lakh.

मेरे youtube channel पर भी visit करे